Making Offshoring A Success!

As the ecosystem in India is growing more and more, firms are looking to hire specialists in their offshore teams. So let’s understand who is considered an experienced professional in offshoring parlance.

Someone with at least 3 years of experience working with CPA firms in the past from India. We categorized them as level 4,5 and 6 category staff (i.e., Team Leads, Sr. Team Leads, Assistant Managers, and Managers.

Benefits of hiring experience professionals

Complex work can be done

Having years of experience means they can take on complex tasks with efficiency and attention to detail.

Better attrition management:

If you have experience person working, he can take responsibility of hiring, onboarding and training any new recruit offshore. Hence it may mitigate some challenges related to attrition.

Onshore staff review time goes down:

The work when done is reviewed by experience reviewer offshore, then onshore supervisor/manager’s review significantly goes down.

More work done offshore:

Leveraging the expertise of experienced professionals, the firm can expect more work can be done by offshore team. They can allocate more tasks to their offshore team.

Quality of review improves:

When experienced offshore staff thoroughly reviews the work, it enhances the confidence of onshore supervisors and managers in the data input. Consequently, onshore staff can now concentrate on reviewing from a perspective of planning, advisory, and adding value.

Helps in better end-client services:

Onshore team can have more time for clients and can provide more value to client.

Following are important considerations before hiring experienced professionals

- Level 4 and above category is in tremendous demand. Big 4 and larger firms are hiring big time

- They are only available in full-time roles & around the year (no temp & no part time)

- Typically, we offer an experience profile only to clients who have an existing team/hiring at least three or more offshore staff with us. These professionals prefer to work with a team instead of working solo. So generally available for managing a team and not in an individual role

- Some of these staff members (not all) will come from Big 4 and large accounting firms, so they may only have deep experience in a particular area

- They would seek flexibility in terms of work from home or hybrid working as Big 4 and large firms are already offering the same (but we will let you know in advance before hiring)

- Fees shall be from $20/hour to $50/hour, depending on experience

- Staffing time from confirmation of hire shall be about 30 to 90 days (depending on the notice period of the prior employer)

- This staff is available for very high salaries, so we must be thoughtful while hiring. We will offer them once you confirm

- Also, two more perils in staffing with experience profiles. First, even after accepting the offer, we have seen staff not sometimes joining (either they are retained by existing employers or they found a better opportunity and took that). The second one is that the attrition is very high in this experience bracket because they have options. We have to continue to make an effort to retain them. So we need to plan and hire these profiles carefully

In the IT industry, hiring freelancers or working with mom-and-pop shops from developing economies has been a recurrent practice. However, offshoring for accounting firms and other industries is not the same.

There are 2 different strategic standpoints:

- A. First, accounting talent requires a specialized skill set

- B. Accountants are an easy target for data theft and cyberattacks as they deal with clients' personal information

As enticing as it may seem it’s important to consider all the points before making a decision.

Here are the top 9 reasons why offshoring your work to freelancers might not be the best idea.

1. Lack of a legal agreement

Ideally, with offshoring, you should have a service agreement, a rock-solid NDA, and privacy compliance to lay the foundation of the job. With laws about freelance work differing from country to country, you might end up with nothing more than a paper deemed or ad-hoc contract. The potential for data confidentiality is, thus, extremely uncertain. In the case of any breach or violation, the possibility of legal recourse is quite unlikely.

2. Data violation is a big issue

Typically, most freelancers work out of developing countries, with a few exceptions. According to the global payment platform Payoneer’s Global Gig Economy Index, Ukraine, Spain, Brazil, Pakistan, India, the Philippines, and Bangladesh come under the fastest-growing freelancer markets. There have been numerous prior instances of IRS tax fraud, IRS refund fraud, and various credit card/bank transfer frauds originating in these countries. This poses a massive risk to the data confidentiality between you and your clients, potentially ruining your reputation and brand in the market.

3. Absence of accountability

Freelancers and small mom-and-pop shops rarely work with a single client at a time, especially for the long term. They usually juggle multiple clients and multiple responsibilities at the same time. This makes missing deadlines and fluctuating quality of work a much more likely possibility. Also, their perspective is that if they lose you as a client, they will gain a new one from the marketplace. In such a situation, it will be an added task for you to ensure the level of commitment and quality of the submitted work.

4. Internet issues & cyberattacks

Massive power outages lasting hours are common even in metropolitan cities, much less in semi-urban and rural areas in developing countries. Freelancers and mom-and-pop shops often rely on flimsy mobile data or home broadband to carry out their responsibilities. Faulty communication will thus be a habitual issue you must prepare for when hiring freelancers. This can also be a source of cyberattacks because often, these networks are not firewall-protected or don’t have any security

5. Risk in reliability

With an excellent offshore service provider, recruitment is carried out only after the individual passes a stringent background check. With freelancers, background checks are challenging and time-consuming to carry out. With their identity and professional capabilities being difficult to determine, a constant risk exists while working with them. Often, there have been instances where the freelancer, for whatever reason, fell off the radar amid a busy tax season. ‘Ghosting’ is a prevalent risk while dealing with freelancers

6. Unavailability of senior-level talent

The freelancing industry has largely been a gateway for freshers and self-supporting professionals to gain financial independence and professional growth. If you are looking for a senior-level talent, you most likely will not find them freelancing.

7. Unsustainable in the long-term

Freelancing may seem cost-effective at first; however, it’s not a long-term solution for accounting firms. All the points mentioned here highlight the limitations and explain how they can be unhealthy for your firms overall success.

8. Not a team player

For your firm's continued growth and success, you must work with individuals who, at their core, have similar objectives. Freelancers are mainly motivated by the lack of structure, financial independence, and diversity in clientele.

9. Client poaching

Lack of an agreement sometimes leads to situations wherein cunning freelancers and mom-and-pop shops reach out directly to a firm's client and try to pitch their services, bypassing accounting firms and sell them cheap.

MYCPE One takes data security and privacy very seriously as a company that handles sensitive financial information. To ensure that its services are delivered securely and responsibly, MYCPE One has implemented rigorous security and privacy measures, including compliance with SOC, ISO, and GDPR standards.

SOC 2 type II certification:

We recently attained our SOC 2 Type II certification, a voluntary compliance standard for service organizations developed by the American Institute of CPAs (AICPA). It specifies how organizations should manage customer data. It's based on the following Trust Services Criteria: security, availability, processing integrity, confidentiality, and privacy. SOC 2 certification is a recognized standard in the industry. Implementing it means we comply with various regulatory frameworks and standards such as GDPR, HIPAA, and PCI-DSS.

ISO 27001:2013 Certification:

Is the international standard for information security management systems. The certification confirms that MYCPE One has implemented comprehensive security controls to protect its clients' data from unauthorized access, theft, and loss. The ISO 27001 certification process involves a rigorous external audit by a third-party certification body, which ensures that our security controls meet or exceed industry best practices. ISO (International Organization for Standardization) is a global standard-setting body that develops and publishes international standards for various industries and sectors.

GDPR Compliance:

We are compliant with the General Data Protection Regulation (GDPR), a comprehensive privacy law regulating how businesses handle the personal data of EU residents. The GDPR requires businesses to implement appropriate technical and organizational measures to protect personal data and respect data subjects' privacy rights. To comply with the GDPR, MYCPE One has implemented several measures, including data protection policies and procedures, employee training on data protection, regular security audits, and data breach response plans. MYCPE One has also appointed a Data Protection Officer (DPO), who oversees the company's compliance with GDPR requirements.

Security Protocols and Practices:

Several measures have been put in place to ensure security in the workplace. Firstly, mobile phones are not allowed in the work area. Secondly, the work area is paperless, and USBs, pens, and printers are disabled. Internet access is monitored, and personal emails or social media are prohibited. The system has firewall protection and multi-factor authentication facilitated, and key cards control access to the work area. In addition, 24x7 CCTV surveillance is in place. The company is GDPR compliant and ISO 27001 certified, with cyber security insurance and E&O insurance. For those working from home, employee monitoring software is also in place. All these measures have been taken to ensure the security and confidentiality of the work.

“As an accounting firm, one of the main concerns when considering offshoring is how the existing team would feel about the decision. Will they feel threatened by the thought of shipping jobs offshore and become insecure about their own positions within the company? This could make employees feel undervalued, negatively affecting their morale and productivity.”

So what shall you do about this?

Transparent communication:

It becomes more important to communicate a firm's ideas and vision on offshoring clearly. Lack of communication creates anxiety and skepticism, leading to dissatisfaction and sometimes even attrition.

Dispelling the myth of job insecurity:

It's a valid concern, and it's essential to address it upfront. If not handled correctly, it can have a domino effect on their productivity and motivation. Let them know what functions/tasks shall be done by the offshore team, and also tell them their jobs are safe.

Involve them in the process of offshoring:

From the beginning, they should be involved in the process of offshoring. Giving them ownership of tasks like starting and integrating offshoring, interviewing and onboarding new offshore staff, etc. This will make them feel more empowered.

Explaining rationale & long-term value:

To be successful, you want people to believe and become invested in your vision. Explain that you are turning to global offshoring as a growth strategy, not a cost-cutting strategy, to reassure your local team that their jobs are safe. This isn't about saving money. In-house team members currently stuck in front of a screen doing process-driven work will be able to devote more time to strategic and client-facing tasks. They need to know that this will bring more work & life balance to generally overburdened onshore teams.

How the world is moving in this direction:

Adaptation to offshoring becomes easier when the team knows that this is where all other accounting firms are also moving. If you want to retain your competitive edge and continue serving clients better, you must embrace offshoring.

Onshore Staff Bias needs to be avoided:

Sometimes, we encounter a situation where an onshore staff member, despite being given clarity, is hesitant or resistant to the idea of offshoring. This can have multiple negative impacts. Firstly, it can make offshore staff feel unwelcome in the firm. Secondly, offshoring may not proceed smoothly, because of inaccurate feedback, insufficient staff training, onboarding, and improper allocation of work etc. Owners and partners may not get an accurate picture of the situation if they are not directly working with the offshore staff. To address this problem, we suggest holding joint meetings atleast initially with offshore staff and implementing the concept of an onshore anchor, which can play a vital role in ensuring the success of offshoring.

Make it a two-way communication process:

Let it not be a question-answer session; the way you are eager to learn more about the applicant, they are equally curious about you and the process, so encourage them to ask.

English is their 2nd language:

English is a second language in India, and typically people speak with an accent. If during your communication, you are not able to understand something, it’s OK, you can always ask them to repeat it.

Be interview ready:

Make sure you know their CV well before interviewing and have questions ready based on their experience/skill set.

Right evaluation of technical skills:

Whatever roles you are looking for in your firm, confirm in the interview whether they have the experience and knowledge mentioned in their resume.

Cultural awareness:

Be aware of the cultural differences when developing your offshore accounting team. Taking a genuine interest in your offshore team will go a long way in developing a healthy working relationship.

Good communicators v/s excellent communicators:

Staff in client-facing roles require better communication skills. However, if the role requires communication limited to only the team, then even average/good communication skills will suffice.

Make sure you conduct a test:

Before interviewing any candidate, you must conduct a test by providing a project or assignment. Make sure these tests do not exceed more than 2 hours.

Make them comfortable:

It has been observed that there is a certain level of inherent fear in offshore staff while talking to clients. So encourage them to ask questions and make them feel comfortable.

Set clear expectations:

Holding someone accountable for something they don’t fully understand is unconscionable. Take time at the start to educate your offshore staff on your expectations. This can be accomplished by clearly defining and explaining their role, briefing them on the tasks at hand, prioritizing projects and tasks, and finally, having them take ownership of their work by allowing the opportunity for feedback.

Define methods of performance monitoring and tracking:

Performance management and review is imperative to get the most out of your offshore team. Like your expectations, these methods must be well-defined and clear. Provide all team members with quantifiable KPIs, such as task completion within a planned time and budget. Additional qualitative indicators, including feedback, should be considered. Establish a way to track the KPI progress and review compliance routinely.

Align your remote workers with the greater team vision:

Let’s be honest – One of the main issues when working with the offshore staff is a perceived lack of initiative and big-picture understanding. This can be attributed to a cultural gap and treating offshore staff unequally to the onshore team. However, this is also one of the easiest issues to resolve. Instead of keeping them at arm’s length, treat your offshore team like your onshore workforce. From the start, fully explain your company’s mission and vision. Include the offshore team in all communication and company syncs, and hold regular virtual meetings. You will have an efficiently-performing team when you make them feel like another team member.

The graveyard shift is a work shift timing that runs from late night (7 pm Local Indian Time and after) to early morning (4- 4:30 am Local Indian Time).

Challenges:

- Completely disrupts the work-life balance. It becomes difficult for our staff to balance work responsibilities with family and social life.

- Working overnight shifts can disturb the body's normal condition. It negatively impacts health in the long term.

- Working overnight shifts can be challenging and demanding, leading to higher burnouts and turnover rates. This can create additional stress for managers who must continually recruit and train new employees.

Non-end client-facing roles:

As non-end client-facing roles require minimal client communication, 3-4 hours of overlap (crossover hours) is enough to run the process smoothly. All our clients are happy with the overlap (crossover hours) of up to 3-4 hours because most communication happens within the team.

The client team ensures they complete meeting with the offshore team within the first hour of the first half of the day. This helps us to pay better attention to our employees because nobody wants to work in the graveyard shift.The graveyard shift is a work shift timing that runs from late night (7 pm Local Indian Time and after) to early morning (4- 4:30 am Local Indian Time).

Working overnight shifts can be challenging and demanding, leading to higher burnouts and turnover rates. This can create additional stress for managers who must continually recruit and train new employees.

End client-facing roles:

As the end client-facing roles need to interact with clients, they require more overlap than 3-4 hours, We make sure that these roles have a 6-7 hours overlap in U.S. timing, i.e, they work almost in U.S. hours.

For people working in this shift we request clients to allow them to work hybrid (first half from the office and second half from home). We still face challenges with the PST Time Zone for this role. Especially when Big 4 and large firms in India are providing 10 am to 6 pm local time jobs and we have to compete with them.

Making Offshoring a Success

You should "buddy-up" offshore staff with a maximum of one to two onshore staff members instead of mapping them with multiple resources. Using the overlap will also determine how you integrate offshore and onshore teams. The overlap occurs when the onshore and offshore teams' working hours overlap to ensure smooth communication and collaboration. An overlap of 2-3 hours is required to develop efficient offshore relationships. This is when offshore and onshore teams can meet regularly to discuss work, and onshore staff can train offshore team members.

What are the benefits of the buddy system?

Pushes more work offshore

As the relationship grows, the onshore team can shift more tasks to the offshore team, which means your team can focus on other areas of firm growth.

Smooth training and onboarding

Onboarding and training have become seamless, and today, offshore staff members always have a “go-to” resource if they have questions or inquiries about items they don't understand, thereby facilitating a prompt resolution.

Works as “one team”

Onshore buddies would be responsible for both the quantity and the quality of the work done by offshore staff members. They work as “one team” because they know their performance is aligned. Onshore buddies would ensure their offshore buddies' workflow is full for continuous output.

Reduces confusion and increases accountability

When your offshore staff is mapped only to one or two onshore staff members, it reduces confusion. This holds everyone more accountable and streamlines reporting of the offshore staff member(s) mapped to them.

When we asked Kim Dollin, CPA Principal Somerset CPAs & Advisors, why you wanted to start with 6 staff members right away when you had never tried offshoring before. We advise you to start slowly and hire one staff at a time. She responded,

“We have our internal training and onboarding process for our new staff members in our firm. If I onboard them one by one, This process would be time-consuming. Instead, we can onboard all 6 of them right away, saving much of our onboarding time.”

Investing in a proper onboarding process can set your offshore team up for success. Effective onboarding can help you build a strong foundation. While the process may be similar, each client has unique needs that require a customized roadmap, each client also has their own needs and processes.

Points of consideration in onboarding offshoring staff

Onboarding process

Developing an onboarding process for new staff members is important; this includes training videos/manuals, SOPs, role/task clarity, details on the nature of the client, etc.

Role clarity

Explaining clear roles and responsibilities from the start and ensuring new employees understand the expectations and targets for their position.

Continuous feedback

Provide ongoing reviews and feedback to new employees throughout the onboarding process to ensure they feel supported and are moving in the right direction and if not then you can course correct quickly.

Progressive reviews

Regularly review of new employees' progress and provide constructive feedback. This can help them meet performance expectations and feel supported throughout onboarding.

Training and handholding

Provide training and handholding to new employees, similar to how you would work with onshore staff.

More experience means less onboarding time

Staff may need less help onboarding/hand holding if the staff member's experience is higher.

Joining Time

Level 1 to 3 Profile

Would be 3 to 4 weeks,

Level 4 Profile

would be 4 to 5 weeks

Level 5 to 6 profile

would be 8 to 10 weeks

*Notice period to leave the previous employer is higher for more experience profiles.

Onboarding Process

| Pre-Joining (1-3 Weeks) | Post-Joining (1-4 Weeks) | |||||

|---|---|---|---|---|---|---|

| Sign up & Interview | IT Set up & Orientation | Joining | Week 1-2 | Week 2-4 | Week 4+ | |

| Things To be Accomplished | Introductory Call | Onboarding Call | Staff Starts Working | Watching past recorded videos | Understanding Client | Starts on Live Projects & Clients |

| Interview - Test | IT Set up | Initial Training | Understanding Processes | Practice Simulation Client | Productivity Start Increasing | |

| Staff Confirmation | Staff Orientation Call | Continuous Review | Understanding SOPs/Job Role | Timely & Ongoing Review & Feedback | Periodic Review & Feedback | |

| Involvement in Process (Review & Feedback) | Very High | Very High | Very High | Very High | High | Normalizes |

At MYCPE One the Offshore Success Advisor plays a crucial role in the relationship, acting as an Offshoring Success Coach and go-to person for clients. We always say that your Offshore Success Advisor is your HR for the offshore team. Account Managers play an important role along with the Onshore Anchor in integrating onshore and offshore teams.

The Offshore Success Advisor helps with:

- Onboarding new team members, ensuring a smooth transition and proper integration into your team

- Getting your IT set up

- Setting up orientation calls between your team and the offshore team

- Managing and resolving queries/feedback/reviews between the clients and offshore teams

- Periodic review calls & meetings with the client team and offshore staff

- Invoicing, collection, fee revision etc. and related queries

- Capacity planning to firms, i.e., to increase or reduce the size of the offshore team based on current and future workflow

- Work timing changes for offshore staff to provide more overlap or to provide flexibility in leaving early and avoid working late nights in india

- Work mode changes allowing work from home or hybrid work flexibility to staff members

- Leave management of staff members

- New hiring or increasing or reducing the number of working hours

- Staff replacement when an existing staff member needs to leave because of some reasons or is required to be replaced

- Any troubleshooting like IT issues, lack of staff proactiveness, false reporting by staff, replacement of staff, etc.

- Getting client requested staff training accomplished in recommended topics or subject areas by closely working with our L & D team

- Makes you aware about policy development and changes in the company

- Overtime, if any

- Managing and resolving any staff or client issues

- End to end offshore team management & troubleshooting

Well, what task can be offshored depends on a few things

Readiness

To what extent is the firm and its team ready to offshore considering technology, process, and understanding.

Training and process

To what extent onboarding, hand-holding, and training is provided, and to what extent have we documented our process?

Identified task

Have you identified service areas, tasks, and processes that need to be offshored first and after that?

Talent

If we hire experienced talent, things may kick start right away compared to someone who is fresh and requires training.

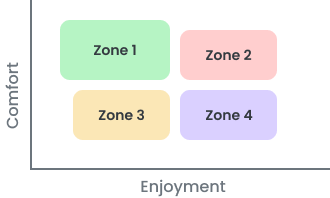

Comfort and enjoyment approach to identify task that can be offshored

There are four zones as per the comfort and enjoyment level of the employee:-

ZONE 1 (High Comfort, Low on Enjoyment): Phase I

Here is where your onshore employee is comfortable but is not enjoying the work. This shall be first delegated to the offshore staff so that onshore staff can free up their time for more critical tasks.

ZONE 2 (High Comfort, High on Enjoyment): Phase II

When staff members enjoy their work and have the necessary skills, making them comfortable with the task. Onshore employees can provide training and onboard offshore staff, creating an ideal situation for all staff members.

ZONE 3 (Low Comfort, Low on Enjoyment): Phase III

The zone that requires the highest level of attention where an onshore employee is neither comfortable doing a particular task nor enjoys it. The staff has no clarity on the role or is a misfit. Here the first requirement is handholding and training to be provided to staff members; after that, experienced staff in the onshore and offshore teams can take on this task gradually.

ZONE 4 (Low Comfort, High on Enjoyment): Phase IV

This task is usually super complex and requires a lot of research, etc. This zone entails employees who like to do the work but lack the technical knowledge and need to be trained. Once it gains significant technological know-how, this task usually needs to be done by a team onshore, then can gradually be offshored.

Tax Related Task

| Tax Related Task | Phase 1 | Phase 2 | Phase 3 | Phase 4 | ||||

|---|---|---|---|---|---|---|---|---|

| Onshore | Offshore | Onshore | Offshore | Onshore | Offshore | Onshore | Offshore | |

| Onboarding a New Client | 80% | 20% | 60% | 40% | 50% | 50% | 30% | 70% |

| Preparation & Review | 40% | 60% | 20% | 80% | 0% | 100% | 0% | 100% |

| Document Collection | 60% | 40% | 40% | 60% | 20% | 80% | 20% | 80% |

| Client Follow-ups/ Communication (Emails/Calls) | 80% | 20% | 60% | 40% | 40% | 60% | 20% | 80% |

| Tax Projections | 80% | 20% | 60% | 40% | 40% | 60% | 20% | 80% |

| Tax Advisory & Planning | 100% | 0% | 100% | 0% | 80% | 20% | 80% | 20% |

| Client Meetings | 100% | 0% | 100% | 0% | 80% | 20% | 80% | 20% |

| Year-Round Tax Advice | 100% | 0% | 100% | 0% | 80% | 20% | 80% | 20% |

| Quarterly Reviews | 100% | 0% | 100% | 0% | 80% | 20% | 80% | 20% |

| Invoicing & Fee Collection | 80% | 20% | 60% | 40% | 40% | 60% | 20% | 80% |

| Tax Notice Replies | 60% | 40% | 40% | 60% | 40% | 60% | 20% | 80% |

| Tax Representation Work | 100% | 0% | 90% | 10% | 90% | 10% | 60% | 40% |

| Total | 60% | 40% | 50% | 40% | 30% | |||

Over the period, more then 60% of tax work in firm can be done by offshore team

Day to Day Back Office/Accounting Task

| Day To Day Task | Phase 1 | Phase 2 | Phase 3 | Phase 4 | ||||

|---|---|---|---|---|---|---|---|---|

| Task | Onshore | Offshore | Onshore | Offshore | Onshore | Offshore | Onshore | Offshore |

| Paying Bills | 20% | 80% | 10% | 90% | 0% | 100% | 0% | 100% |

| Reconciliation & Data Entry | 20% | 80% | 10% | 90% | 0% | 100% | 0% | 100% |

| Invoicing/Collection | 20% | 80% | 10% | 90% | 0% | 100% | 0% | 100% |

| Payroll Processing | 20% | 80% | 10% | 90% | 0% | 100% | 0% | 100% |

| Expense Approval & Tracking | 20% | 80% | 10% | 90% | 0% | 100% | 0% | 100% |

| Cashflow Management | 20% | 80% | 10% | 90% | 0% | 100% | 0% | 100% |

| Inventory Reports/Reconciliation | 20% | 80% | 10% | 90% | 0% | 100% | 0% | 100% |

| Expense Recording/Reporting | 20% | 80% | 10% | 90% | 0% | 100% | 0% | 100% |

| Total | 20% | 80% | 10% | 0% | 0% | |||

Over the period, 100% of transaction/day to work can be done by offshore team

Periodic and Reporting Task

| Periodic Task | Phase 1 | Phase 2 | Phase 3 | Phase 4 | ||||

|---|---|---|---|---|---|---|---|---|

| Task | Onshore | Offshore | Onshore | Offshore | Onshore | Offshore | Onshore | Offshore |

| Onboarding a New Client | 80% | 20% | 60% | 40% | 50% | 50% | 30% | 70% |

| Month-end Closure | 40% | 60% | 30% | 70% | 20% | 80% | 10% | 90% |

| Financial Reporting | 40% | 60% | 30% | 70% | 20% | 80% | 10% | 90% |

| Operational Reporting | 60% | 40% | 50% | 50% | 40% | 60% | 30% | 70% |

| Companywide KPI Review & Recommendation | 60% | 40% | 50% | 50% | 40% | 60% | 30% | 70% |

| Budgeting | 60% | 40% | 50% | 50% | 40% | 60% | 30% | 70% |

| 12 Month Forecasting & Cashflow Advisory | 60% | 40% | 50% | 50% | 40% | 60% | 30% | 70% |

| Total | 60% | 40% | 50% | 40% | 30% | |||

Over the period, more than 60 % of periodic and reporting task can be done by offshore team

Strategic and Advisory Task

| Advisory & Strategic Task | Phase 1 | Phase 2 | Phase 3 | Phase 4 | ||||

|---|---|---|---|---|---|---|---|---|

| Task | Onshore | Offshore | Onshore | Offshore | Onshore | Offshore | Onshore | Offshore |

| Revenue Recognition | 80% | 20% | 70% | 30% | 60% | 40% | 50% | 50% |

| Team Planning | 80% | 20% | 70% | 30% | 60% | 40% | 50% | 50% |

| Team Performance Evaluation | 80% | 20% | 70% | 30% | 60% | 40% | 50% | 50% |

| Incentive Plans & ESOPs | 80% | 20% | 70% | 30% | 60% | 40% | 50% | 50% |

| Department Performance & Reports | 60% | 40% | 50% | 50% | 40% | 60% | 30% | 70% |

| Performance by Project | 60% | 40% | 50% | 50% | 40% | 60% | 30% | 70% |

| Dedicated Offshore Success Advisor | 100% | 0% | 90% | 10% | 80% | 20% | 70% | 30% |

| Meetings (Board/Monthly) | 80% | 20% | 70% | 30% | 60% | 40% | 50% | 50% |

| Capital Raise | 80% | 20% | 70% | 30% | 60% | 40% | 50% | 50% |

| Bank Relationships | 100% | 0% | 90% | 10% | 80% | 20% | 70% | 30% |

| Resource Planning | 100% | 0% | 90% | 10% | 80% | 20% | 70% | 30% |

| Strategic Advisory | 100% | 0% | 90% | 10% | 80% | 20% | 70% | 30% |

| Exit/M & A | 100% | 0% | 90% | 10% | 80% | 20% | 70% | 30% |

| Total | 90% | 10% | 20% | 30% | 40% | |||

Firm would still, continue to do significant amount of strategic and advisory work through onshore team

When both your in-house team and your offshore team know about each other’s culture, it will become easy for both teams to communicate and collaborate effectively. How we can do the same.

Onshore anchor and Offshore Success Advisor should organize “virtual happy hours” once a month on Fridays' for an hour, which means a free-wheeling conversation

Our team will share our festival celebrations and events videos with our firm client and their staff Engaging your offshore team/onshore team in virtual games/ activities is another way to build collaborative relationships and create bonding

Given that teams are from different subcontinents, cultural differences are understandable. Socially linking the teams provides stability and ease of understanding. Even if this isn't the case, leaders must promote regular interaction among team members to reinforce relations, clear cultural misunderstandings, and form close-knit, cross-functional teams. Creating a unified culture of belonging across borders, time zones, and statuses is important.

5 points must be included in your plan to unify offshore and onshore team culture.

- The offshore team shall be treated as an integral part of the firm Whatever your cultural/firm rituals are - keep doing them! And keep them the same for both teams

- Regular and frequent meetings are important to bring the whole team on the same platform giving equal

- Opportunity to everyone to be heard, perform, grow, give feedback, suggestions, and ideas

- Building an environment wherein everyone feels secure and, at the same time, committed to performing.

- Neither onshore nor offshore team members should be under the hanging sword of job insecurity

- Clearly build and communicate Do's and Don'ts of your firm's culture

The graveyard shift is a work shift timing that runs from late night (7 pm Local Indian Time and after) to early morning (4- 4:30 am Local Indian Time).

Challenges:

- Completely disrupts the work-life balance. It becomes difficult for our staff to balance work responsibilities with family and social life.

- Working overnight shifts can disturb the body's normal condition. It negatively impacts the health in the Long-term.

- Working overnight shifts can be challenging and demanding, leading to higher burnouts and turnover rates. This can create additional stress for managers who must continually recruit and train new employees.

Non-end client-facing roles:

As non-end client-facing roles require minimal client communication, 3-4 hours of overlap (crossover hours) is enough to run the process smoothly. All our clients are happy with the overlap (crossover hours) of up to 3-4 hours because most communication happens within the team.

The client team ensures they complete meeting with the offshore team within the first hour of the first half of the day. This helps us to pay better attention to our employees because nobody wants to work in the graveyard shift.The graveyard shift is a work shift timing that runs from late night (7 pm Local Indian Time and after) to early morning (4- 4:30 am Local Indian Time).

End client-facing roles:

As the end client-facing roles need to interact with clients, they require more overlap than 3-4 hours, We make sure that these roles have a 6-7 hours overlap in U.S. timing, i.e, they work almost in U.S. hours.

For people working in this shift we request clients to allow them to work hybrid (first half from the office and second half from home). We still face challenges with the PST Time Zone for this role. Especially when Big 4 and large firms in India are providing 10 am to 6 pm local time jobs and we have to compete with them.

Making Offshoring a Success

-

Long-Term Plan - Phase Wise Building

-

Documented Processes

-

Involve Existing Offshore Staff

-

Strategic Role of Offshoring

-

Allowing Client Interaction. (End Clients)

-

KPI - % Task/Staff Offshore (Manager/Partner)

-

KPI - Yearly Productivity Hrs (Tracked Collectively/Team)

-

KPI - % of Billable Time moved to India (Internal Targets)

-

Career Advancement - For Offshore Team

-

Experienced Hiring - Building Offshore Leadership

-

Staff Salaries Top of Market - Improved Retention.

-

Offshore/Onshore Core Team - Travelling to US/India

-

Core Team - Hierarchy - Streamline Reporting

-

Tech Stack Optimization.

-

Cross Training - Prepare for Attrition

-

Review & Feedback

Hiring Non-Technical Staff

What to consider while hiring virtual assistants

Running after the clients, writing e-mails, scheduling meetings, and what not – the life of an accountant is certainly not easy. It is sad that many modern-day accountants are still trying to fit in all these multiple roles, battling with giant obstacles and expectations daily. Virtual Assistants can solve most of these problems.

Do’s and Don'ts of hiring a virtual assistant

Do’s

- Identify Specific Needs

- Evaluate Communication Skills

- Set Clear Expectations

- Offer Initial Training

- Foster a Collaborative Environment

Don'ts

- Rush the Hiring Process

- Underestimate the Importance of Support

- Micromanage

- Ignore Cultural Fit

- Hesitate to Delegate

How to handle virtual assistants

We recommend the CLEAR approach, which ensures that the management of virtual assistants is structured yet flexible, promoting an efficient and supportive work environment.

- C - Communicate Clearly

- L - List Expectations

- E - Encourage Feedback

- A - Adopt Tools

- R - Respect and Recognize

C - Communicate Clearly

Establish frequent and clear lines of communication. Use tools like Slack or Microsoft Teams to ensure messages are delivered clearly and promptly, fostering a strong connection despite physical distance.

L - List Expectations

Clearly define roles, responsibilities, and expectations right from the start. This includes work hours, task priorities, and performance standards to ensure there's no ambiguity.

E - Encourage Feedback

Actively seek and give feedback. This not only aids in continuous improvement but also makes your VA feel valued and part of the team

A - Adopt Tools

Utilize appropriate project management and communication tools to streamline workflow and enhance productivity.

R - Respect and Recognize

Treat your VA with respect and recognize their efforts. Appreciating their work and considering their personal circumstances helps in building loyalty and trust, which are crucial for long-term collaboration.